If you’re looking for retirement investments advice to help you achieve a comfortable retirement, you’ve come to the right place. In this article, we will provide you with valuable insights on understanding retirement investments, the importance of diversifying your portfolio, and factors to consider when choosing the right investments for your future. We will also explore different types of retirement investments, such as Traditional and Roth IRAs, 401(k) plans, and pensions, as well as the benefits of taking advantage of employer contributions. Additionally, you will learn the significance of regularly reviewing and adjusting your investments, and how seeking expert retirement investments advice can help you make informed choices. So, let’s dive in and start planning for a secure and enjoyable retirement together!

Understanding Retirement Investments

Retirement investments are a crucial part of securing a comfortable retirement. By investing your funds wisely, you can ensure that you have enough financial resources to support yourself in your golden years. But what exactly are retirement investments?

Retirement investments refer to the various financial vehicles that are specifically designed to help individuals save for their retirement. These investments allow you to earn returns on your contributions over time, helping to build a nest egg for a financially secure future.

Importance of Retirement Investments

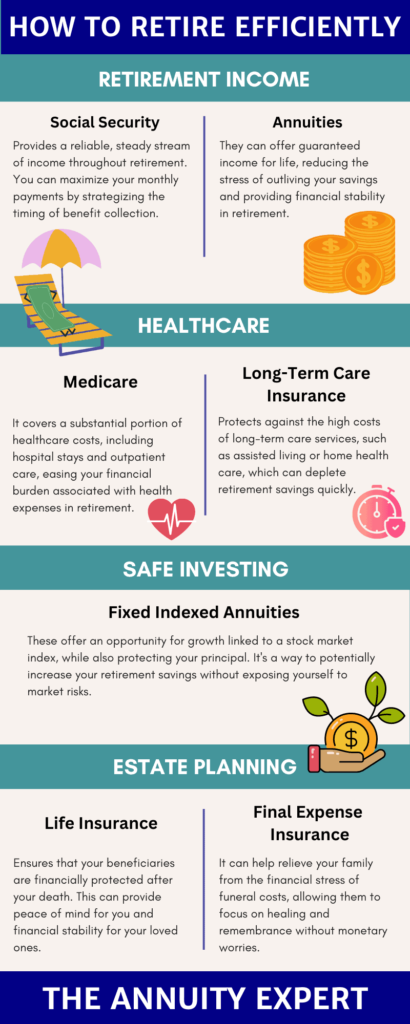

The importance of retirement investments cannot be overstated. With the cost of living constantly on the rise, relying solely on Social Security benefits may not be enough to maintain your desired standard of living during retirement. This is where retirement investments come into play.

By investing your money, you have the opportunity to grow your savings at a faster rate than simply stashing it away in a savings account. Investments such as stocks, bonds, and mutual funds have historically provided higher returns over the long term, allowing your retirement savings to grow and potentially outpace inflation.

Different Types of Retirement Investments

There are several different types of retirement investments, each with its own set of advantages and considerations. Let’s take a closer look at some of the most common retirement investment options:

Traditional IRA

A Traditional IRA (Individual Retirement Account) is a personal savings account that provides individuals with tax advantages for retirement savings. Contributions to a Traditional IRA may be tax-deductible, and the funds in the account grow tax-deferred until withdrawals are made in retirement.

Roth IRA

The Roth IRA is another type of personal retirement account. Unlike a Traditional IRA, contributions to a Roth IRA are made with after-tax funds, meaning you don’t get an immediate tax deduction. However, the earnings in a Roth IRA grow tax-free, and qualified withdrawals in retirement are also tax-free.

401(k) Plans

A 401(k) plan is an employer-sponsored retirement savings plan offered by many companies. These plans allow you to contribute a portion of your salary to your retirement savings on a pre-tax basis, meaning that you won’t pay taxes on your contributions until you make withdrawals in retirement. Some employers even offer matching contributions to incentivize employees to save for retirement.

Pensions

Pensions are retirement plans provided by employers to their employees. With a pension, an employee receives regular payments in retirement based on their salary and length of service with the company. This traditional retirement benefit has become less common in recent years, as many companies have shifted to defined contribution plans like 401(k)s.

Factors to Consider when Choosing Retirement Investments

When it comes to choosing the right retirement investments for your needs, it’s essential to consider several key factors. Here are some important considerations to keep in mind:

Risk Tolerance

Understanding your risk tolerance is crucial when determining which retirement investments are suitable for you. Some investments, like stocks, carry a higher level of risk but also offer the potential for higher returns. On the other hand, more conservative investments like bonds may have lower returns but carry less risk. Assessing your risk tolerance will help you find the right balance between risk and return.

Time Horizon

Your time horizon, or the number of years until you plan to retire, also plays a significant role in determining your investment strategy. If you have a long time until retirement, you may have a higher tolerance for short-term market fluctuations and can consider more aggressive investment options. However, if retirement is just around the corner, you may want to focus on more stable investments to protect your savings.

Investment Goals

Defining your investment goals is essential in tailoring your retirement investment plan. Consider factors such as how much income you’ll need in retirement, whether you have any specific financial goals like purchasing a second home, and how much risk you’re willing to take on. By setting clear investment goals, you can make better-informed decisions about which investments align with your objectives.

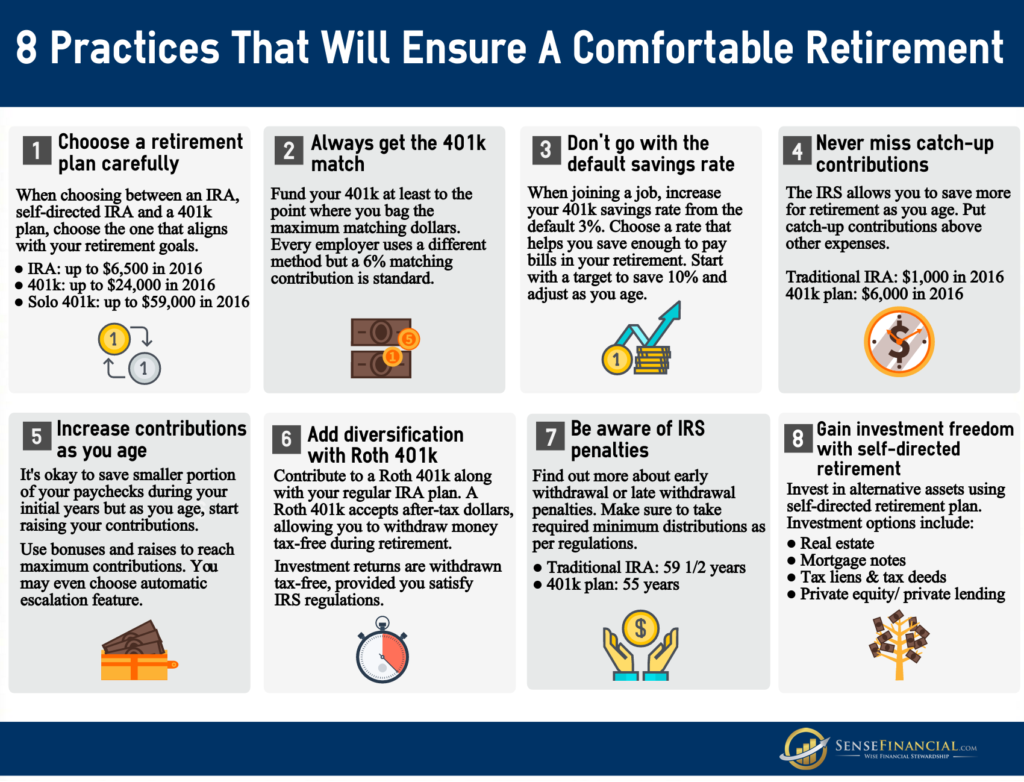

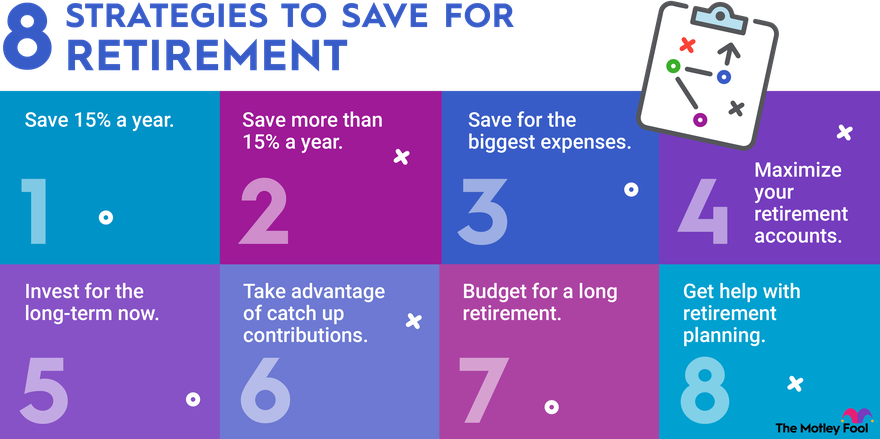

Retirement Investments Advice for a Comfortable Retirement

Now that we have discussed the different types of retirement investments and the factors to consider, let’s delve into some specific retirement investments advice to help you achieve a comfortable retirement:

Diversify Your Portfolio

Diversification is a key principle in retirement investing. By spreading your investments across different asset classes like stocks, bonds, and real estate, you can reduce the impact of any single investment’s performance on your overall retirement portfolio. Diversification helps manage risk and increases the likelihood of earning consistent returns over the long term.

Consider a Mix of Stocks and Bonds

Finding the right balance between stocks and bonds is crucial in achieving both growth and stability in your retirement investments. Stocks offer the potential for higher returns but come with more significant fluctuations in value. On the other hand, bonds provide stability and regular income, which can be essential during retirement. A mix of both can provide a good balance of risk and reward.

Take Advantage of Employer Contributions

If your employer offers a retirement savings plan, such as a 401(k) or pension, be sure to take full advantage of any employer matching contributions. This is essentially free money that can significantly boost your retirement savings. Contribute at least enough to receive the maximum employer match, as this is one of the most effective ways to accelerate your retirement savings.

Regularly Review and Adjust Your Investments

As you progress through different stages of life, your investment needs and priorities may change. It’s essential to regularly review your retirement investments and make any necessary adjustments. This could involve rebalancing your portfolio, reallocating assets, or even seeking professional advice to ensure your investments align with your current financial goals and risk tolerance.

Seeking Expert Retirement Investments Advice

While it’s possible to manage your retirement investments on your own, seeking expert advice can provide valuable insights and help you make more informed decisions. Consider the following options for expert retirement investments advice:

Financial Advisors

A financial advisor specialized in retirement planning can help you navigate the complexities of retirement investments. They can assess your unique circumstances, recommend suitable investment strategies, and guide you towards achieving your retirement goals.

Online Investment Platforms

There are now many online investment platforms available that provide tools and resources to help you make informed investment decisions. These platforms often utilize algorithms and data analysis to recommend personalized investment portfolios based on your risk tolerance and investment goals.

Retirement Planning Services

For a more comprehensive approach, retirement planning services offer a range of services to help you create and manage a retirement investment plan. These services typically include expert advice, portfolio management, and ongoing support to help you stay on track towards a comfortable retirement.

In conclusion, understanding retirement investments and making informed decisions about your investments are crucial for a comfortable retirement. By considering your risk tolerance, time horizon, and investment goals, you can choose the right retirement investments that align with your needs. Additionally, diversifying your portfolio, considering a mix of stocks and bonds, and taking advantage of employer contributions can further enhance your retirement savings. Lastly, seeking expert retirement investments advice can provide valuable guidance and help you maximize the potential of your retirement investments. Start planning and investing for your future today to ensure a financially secure and enjoyable retirement.