Are you a K-12 educator who is starting to think about retirement? If so, you’re in the right place! This article will provide you with valuable insights and information on retirement investments specifically tailored to meet the unique needs of educators in the K-12 sector. From understanding the benefits of a 403(b) plan to exploring various investment options, we’ve got you covered. So sit back, relax, and let’s take a friendly journey into the world of retirement investments for K-12 educators!

Retirement Investments for K-12 Educators

Retirement planning is vital for K-12 educators, as it ensures financial security and stability during their golden years. With the right retirement investments, educators can enjoy a comfortable retirement and pursue their post-work dreams without worrying about money. This comprehensive guide aims to help educators understand the importance of retirement planning, explore retirement investment options, and make informed decisions regarding their retirement savings.

This image is property of www.sec.gov.

1. Importance of Retirement Planning

Retirement planning is crucial because it allows educators to maintain their standard of living and cover essential expenses after they stop working. By starting early and making regular contributions to retirement investments, educators can create a nest egg that provides for their needs and desired lifestyle throughout their retirement years.

1.1 The Need for Retirement Investments

While educators may be eligible for a pension, it is often not sufficient to meet all of their financial needs in retirement. The cost of living continues to rise, and unexpected expenses can arise. Therefore, it is essential for educators to explore additional retirement investment options to supplement their pension income.

1.2 Benefits of Early Retirement Planning

Early retirement planning offers numerous advantages for educators. By starting early, you give your investments more time to grow and benefit from compounding interest. Additionally, effective retirement planning allows you to have a clear understanding of your financial goals, identify the necessary steps to achieve them, and make adjustments as needed over time.

2. Understanding Retirement Investment Options

Educators have two primary retirement investment options: Defined Benefit (DB) pension plans and Defined Contribution (DC) retirement plans. It is crucial to understand the differences between these options to make informed decisions about your retirement savings.

2.1 Defined Benefit (DB) Pension Plans

A Defined Benefit pension plan is a retirement plan provided by your employer, which guarantees a specific benefit amount to eligible employees upon retirement. The benefit is typically based on a formula that considers factors such as salary and years of service. With a DB pension plan, the employer assumes the investment risk, and employees receive a fixed income for life during retirement.

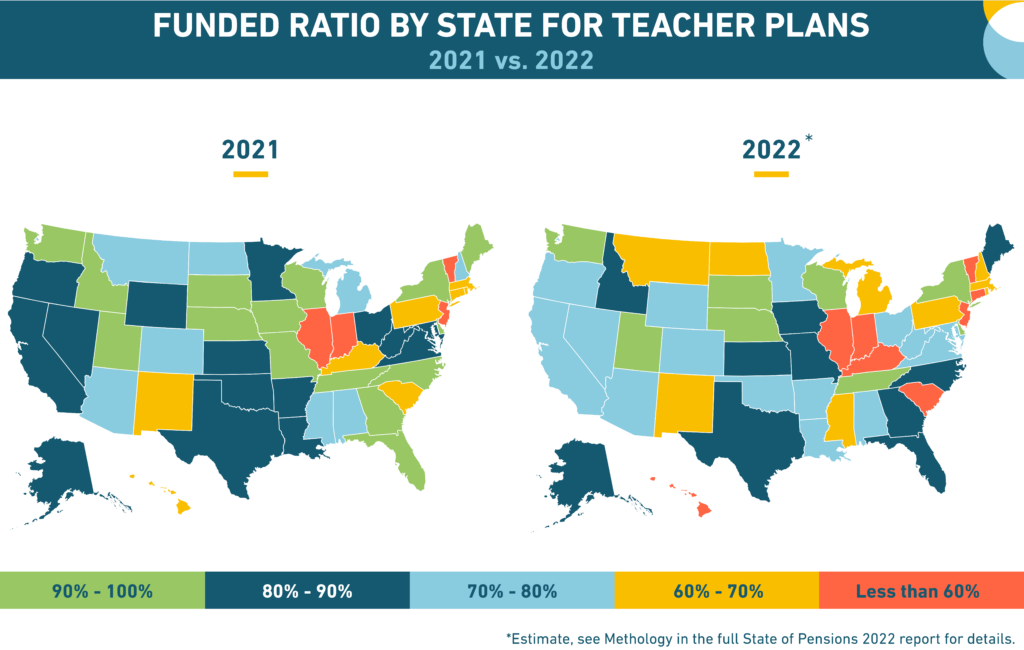

This image is property of equable.org.

2.2 Defined Contribution (DC) Retirement Plans

In contrast to DB pension plans, DC retirement plans require employees to contribute a portion of their salary into individual retirement accounts. This money is then invested, and the account balance grows over time. The final retirement income amount is determined by the contributions made and the investment performance of the account. DC plans shift the investment risk to the employee, who has control over their retirement account.

3. Exploring Defined Benefit (DB) Pension Plans

Defined Benefit pension plans offer educators the security of a guaranteed income stream during retirement.

3.1 How DB Pension Plans Work

DB pension plans are designed to provide retired educators with a predictable income based on specific criteria. The plan typically considers factors such as years of service and final average salary to calculate the retirement benefit. Upon retirement, the pension plan pays a fixed monthly income to the retiree for the duration of their life, ensuring financial stability.

3.2 Advantages of DB Pension Plans

One of the significant advantages of DB pension plans is the guaranteed income they offer. This stable income stream allows educators to plan their retirement budget more effectively, as they know the exact amount they will receive each month. Additionally, DB pension plans usually include cost-of-living adjustments, protecting the retiree against inflation.

3.3 Potential Disadvantages of DB Pension Plans

While DB pension plans provide a guaranteed income, there may be some limitations and restrictions that educators should be aware of. For example, some plans have specific eligibility requirements and vesting periods that need to be met in order to receive the full pension benefit. Additionally, the amount of the pension may be limited by factors such as salary caps or limits on the number of years of service.

This image is property of si-interactive.s3.amazonaws.com.

4. Considerations for Defined Contribution (DC) Retirement Plans

Defined Contribution retirement plans offer educators flexibility and control over their retirement savings.

4.1 Introduction to DC Retirement Plans

DC retirement plans, such as 401(k) plans and 403(b) plans, provide educators with the opportunity to contribute a portion of their salary toward their retirement savings. These plans allow for tax-deferred growth of investments, and the funds in the account can be invested in various assets such as stocks, bonds, and mutual funds.

4.2 Types of DC Retirement Plans

There are various DC retirement plans available to K-12 educators, with the most common being the Traditional 401(k) plan, Roth 401(k) plan, and 403(b) plan. Each plan has its own unique features and benefits, and educators should carefully consider their options to make the most suitable choice for their retirement needs.

5. Traditional 401(k) Plans for K-12 Educators

Traditional 401(k) plans provide educators with a tax-advantaged way to save for their retirement.

5.1 Features and Benefits of Traditional 401(k) Plans

Traditional 401(k) plans allow educators to contribute a portion of their pre-tax salary to their retirement account. The contributions are tax-deductible, which reduces the educator’s taxable income. Additionally, the investment growth in the account is tax-deferred until withdrawals are made during retirement.

This image is property of si-interactive.s3.amazonaws.com.

5.2 Employer Matching Contributions

Many employers offer matching contributions to incentivize educators to save for retirement. These matching contributions can significantly enhance the total amount saved in the 401(k) account. Educators should take advantage of any employer matching contributions to maximize their retirement savings.

5.3 Limitations and Tax Implications

While Traditional 401(k) plans offer tax benefits and employer matching contributions, educators should also be aware of the limitations and tax implications. Traditional 401(k) withdrawals are taxed as ordinary income during retirement. Additionally, withdrawals made before the age of 59 ½ may be subject to early withdrawal penalties.

6. Roth 401(k) Plans for K-12 Educators

Roth 401(k) plans provide educators with a unique retirement savings option that offers tax-free withdrawals during retirement.

6.1 Advantages of Roth 401(k) Plans

With a Roth 401(k) plan, educators contribute a portion of their salary after-tax. While this means they do not receive an immediate tax deduction, all qualified withdrawals during retirement are tax-free. Roth 401(k) plans are especially advantageous for educators who expect to be in a higher tax bracket during retirement.

6.2 Eligibility and Contribution Limits

Educators should check with their employer to determine if a Roth 401(k) option is available in their retirement plan. Additionally, contribution limits for Roth 401(k) plans are the same as traditional 401(k) plans. For 2021, educators can contribute up to $19,500, with an additional $6,500 catch-up contribution for those aged 50 and older.

This image is property of si-interactive.s3.amazonaws.com.

6.3 Tax Treatment and Distributions

One of the main advantages of Roth 401(k) plans is the tax treatment during retirement. Qualified withdrawals from a Roth 401(k) plan are tax-free, as long as certain conditions are met. This can provide educators with significant tax savings and flexibility during their retirement years.

7. 403(b) Plans: Retirement Savings for Educators

403(b) plans are retirement savings options specifically designed for employees of tax-exempt educational organizations.

7.1 Overview of 403(b) Plans

403(b) plans are similar to 401(k) plans but are exclusively available to employees of educational institutions and certain tax-exempt organizations. Like a Traditional 401(k) plan, contributions to a 403(b) plan are tax-deferred and can be invested in various securities, such as mutual funds and annuities.

7.2 Unique Features of 403(b) Plans

One unique feature of 403(b) plans is the ability to make contributions through salary reduction agreements. This allows educators to contribute to their retirement savings directly from their paycheck, making it a convenient and effortless way to save. Additionally, 403(b) plans often offer investment options that align more closely with the needs and preferences of educators.

7.3 Investment Options and Contributions

403(b) plans generally offer a wide range of investment options, including mutual funds and annuities. Educators should carefully review the investment choices available within their plan and select options that align with their risk tolerance and long-term financial goals. It’s also important to review the contribution limits for 403(b) plans, which are the same as traditional 401(k) plans.

8. Individual Retirement Accounts (IRAs)

In addition to employer-sponsored retirement plans, educators can also contribute to Individual Retirement Accounts (IRAs) to further boost their retirement savings.

8.1 Traditional IRAs for Educators

Traditional IRAs allow educators to contribute pre-tax income, reducing their taxable income for the year. The contributions grow tax-deferred until withdrawals are made, at which point they are taxed as ordinary income. Traditional IRAs can be a valuable retirement savings tool, especially if tax deductions are a priority.

8.2 Roth IRAs for Educators

Roth IRAs offer educators the opportunity to contribute after-tax income, similar to Roth 401(k) plans. One advantage of a Roth IRA is that qualified withdrawals are tax-free. Roth IRAs are an excellent option for educators who anticipate being in a higher tax bracket during retirement or who want tax-free growth potential for their retirement savings.

8.3 Comparison of Traditional and Roth IRAs

Deciding between a Traditional and Roth IRA depends on several factors, such as current and future tax brackets, income levels, and personal financial goals. Educators should carefully review the eligibility criteria, contribution limits, and benefits of each type of IRA to determine which option best suits their individual circumstances.

10. Seeking Financial Guidance for Retirement Investments

Making informed decisions about retirement investments can be complex, but seeking professional advice can help educators navigate the process and maximize their retirement savings.

10.1 Importance of Professional Advice

Retirement planning involves various factors, including investment strategies, tax implications, and risk management. A financial advisor with expertise in retirement planning can offer valuable guidance and help educators create a solid retirement plan tailored to their unique needs and goals.

10.2 Consulting Retirement Advisors

When selecting a retirement advisor, educators should seek professionals who specialize in retirement planning for educators and are familiar with the specific retirement plans available to them. These advisors can help educators evaluate their options, implement sound investment strategies, and regularly review and adjust their retirement plan as needed.

10.3 Resources and Tools for Educators

Educators have access to various resources and tools to assist them in their retirement planning journey. Online calculators, retirement planning seminars, and educational materials provided by retirement plan providers and financial institutions can help educators gain a deeper understanding of retirement investments and make informed decisions.

In conclusion, retirement planning is essential for K-12 educators to secure their financial future. By understanding the various retirement investment options available and seeking professional guidance, educators can make informed decisions that will lead to a comfortable and fulfilling retirement. start planning today and ensure that your retirement years are filled with joy, relaxation, and financial peace of mind.