Are you nearing your retirement and looking for smart investment options to secure a comfortable future? Look no further! In this article, we will discuss the incredible potential of discounted bonds as retirement investments. With their attractive pricing and consistent returns, discounted bonds provide a unique opportunity to grow your wealth while minimizing risk. Whether you are a novice investor or a seasoned pro, discovering the benefits of these bonds will surely ignite your interest and help you make informed decisions about your retirement portfolio. Get ready to embark on a journey of financial security and abundance!

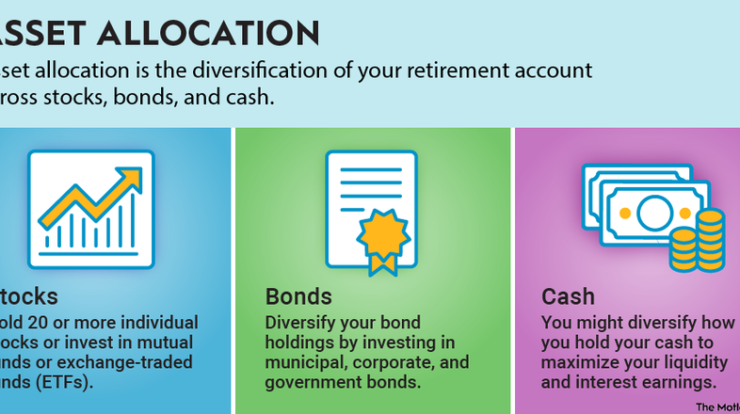

This image is property of www.financestrategists.com.

Understanding Discounted Bonds

What are discounted bonds?

Discounted bonds are bonds that are sold at a price below their face value. This means that the investor can purchase these bonds for less than their maturity value. The discount is essentially the difference between the purchase price and the face value of the bond.

How do discounted bonds work?

Discounted bonds work by providing investors with a way to earn a return on their investment through the difference between the purchase price and the face value of the bond. When a bond matures, the investor receives the full face value of the bond, regardless of the discounted price at which it was purchased. This allows investors to benefit from potential price appreciation over time.

Why invest in discounted bonds for retirement?

Investing in discounted bonds for retirement can provide several benefits. By purchasing bonds at a discount, investors have the opportunity to earn a higher return on their investment. Additionally, discounted bonds can provide a steady income stream, making them a reliable way to generate income during retirement. Furthermore, investing in discounted bonds can help diversify a retirement portfolio, reducing overall risk and providing stability in uncertain market conditions.

Types of Discounted Bonds

Zero-coupon bonds

Zero-coupon bonds are a type of discounted bond that does not pay regular interest or coupons to the bondholder. Instead, these bonds are sold at a deep discount to their face value and the investor receives the full face value of the bond at maturity. Zero-coupon bonds can be an attractive investment for retirement because they offer the opportunity to lock in a guaranteed return without the need to worry about reinvesting coupon payments.

Callable bonds

Callable bonds are another type of discounted bond that can be beneficial for retirement investors. These bonds have a provision that allows the issuer to redeem (or “call”) the bond before its maturity date. When a bond is called, the issuer repays the bondholder the face value of the bond, plus any remaining interest payments. Callable bonds can provide higher yields compared to non-callable bonds, but it’s important to carefully consider the potential risks associated with early redemption.

Convertible bonds

Convertible bonds are discounted bonds that give the bondholder the option to convert their bond into a specified number of shares of the issuer’s common stock. Convertible bonds can be an attractive option for retirement investors because they offer potential capital appreciation if the issuer’s stock price increases. These bonds provide a way to participate in the upside potential of the issuer’s stock while still benefiting from the steady income generated by the bond.

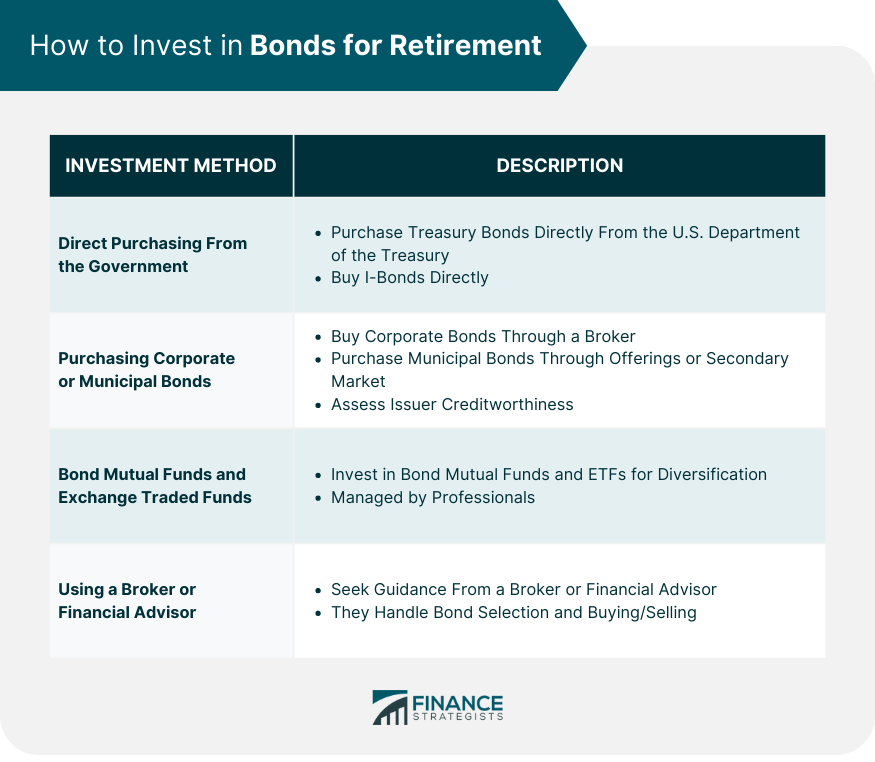

This image is property of www.financestrategists.com.

Factors to Consider

Yield to maturity

When investing in discounted bonds for retirement, it is important to consider the yield to maturity (YTM) of the bonds. The YTM represents the total return an investor can expect to earn if they hold the bond until it matures. It takes into account the discount at which the bond is purchased, the annual interest payments, and the face value of the bond. A higher YTM indicates a potentially higher return on investment.

Creditworthiness of the issuer

The creditworthiness of the issuer is a crucial factor to consider when investing in discounted bonds. It refers to the ability of the issuer to repay the bond’s principal and make interest payments as scheduled. Retirement investors should carefully assess the credit ratings of the bonds they are considering to ensure they are investing in bonds issued by financially stable companies or governments.

Potential tax implications

Investors should also consider the potential tax implications of investing in discounted bonds for retirement. Interest income from bonds is generally taxable, and the tax rate will depend on the investor’s income tax bracket. It’s important to consult a tax advisor to understand how investing in discounted bonds may impact personal tax obligations and to explore strategies for minimizing the tax burden.

Diversification Strategies

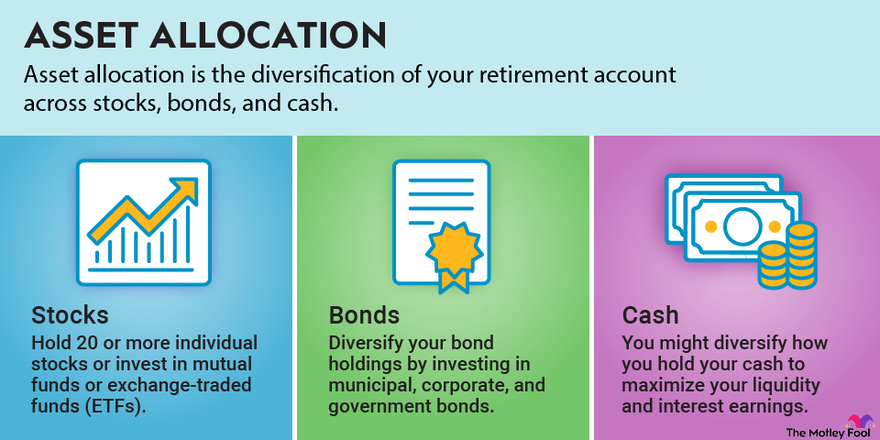

Balancing risk and return

Diversification is a key strategy for retirement investors, and investing in discounted bonds can help achieve a balanced risk and return profile. By allocating a portion of the retirement portfolio to discounted bonds, investors can reduce exposure to other riskier assets such as stocks. This diversification can help smooth out the overall portfolio performance and provide a stable income stream during retirement.

Allocating assets for retirement

When considering discounted bonds for retirement, it is important to allocate assets appropriately. Retirement investors should evaluate their risk tolerance, time horizon, and financial goals to determine the proportion of their portfolio to allocate to discounted bonds. Balancing the allocation of assets between bonds, stocks, and other investment options is crucial for achieving long-term financial security.

Considering other investment options

While discounted bonds can be an appealing option for retirement investors, it is important to consider other investment options as well. Retirement accounts such as individual retirement accounts (IRAs) and employer-sponsored retirement plans provide additional investment opportunities, such as stock mutual funds, target-date funds, and index funds. By diversifying across different types of investments, investors can better manage risk and potentially enhance their overall portfolio returns.

This image is property of www.financestrategists.com.

Risks and Mitigation

Interest rate risk

One of the main risks associated with discounted bonds is interest rate risk. When interest rates rise, the value of existing bonds generally decreases. This inverse relationship occurs because newly issued bonds with higher interest rates become more attractive to investors. To mitigate interest rate risk, retirement investors can consider investing in shorter-term bonds, which are less sensitive to changes in interest rates. Additionally, diversifying across different types of bonds and maturities can help manage this risk.

Inflation risk

Inflation risk refers to the potential erosion of purchasing power over time due to rising consumer prices. For retirement investors, it is important to consider the impact of inflation on the income generated by discounted bonds. While discounted bonds provide a fixed income stream, the purchasing power of that income may decrease if inflation outpaces the bond’s yield. Retirement investors may mitigate this risk by investing in bonds with inflation-protected features or by allocating a portion of their portfolio to assets that have historically outperformed inflation, such as stocks.

Reinvestment risk

Reinvestment risk is the risk that the interest income or coupon payments received from discounted bonds cannot be reinvested at the same rate of return. For retirement investors, this risk can impact the ability to generate future income or achieve investment goals. To mitigate reinvestment risk, investors can consider bond laddering, which involves spreading bond purchases across different maturity dates. This strategy helps ensure that a portion of the portfolio matures and becomes available for reinvestment at regular intervals.

Liquidity Considerations

Assessing the bond market’s liquidity

Liquidity is an important consideration when investing in discounted bonds. Liquidity refers to how easily an investor can buy or sell a bond without significantly affecting its price. Retirement investors should assess the liquidity of the bond market in which they are investing to ensure they can easily transition in and out of bond positions if needed. Highly liquid markets provide investors with flexibility and the ability to react to changing market conditions.

Building a diversified bond portfolio

Building a diversified bond portfolio is essential for retirement investors. By diversifying across different types of bonds and issuers, investors can reduce the impact of individual bond defaults or credit downgrades. Retirement investors should consider investing in bonds issued by different sectors, industries, and geographic regions to spread the risk. Additionally, investors may include bonds with varying maturities to further diversify their portfolio.

Having an emergency fund in place

Retirement investors should also have an emergency fund in place when investing in discounted bonds. This fund should provide a sufficient cash reserve to cover unexpected expenses or financial emergencies. By having readily available cash, investors can avoid the need to sell bonds at unfavorable prices to meet short-term financial needs. An emergency fund ensures that discounted bond investments can be held until maturity, allowing investors to benefit from their full face value.

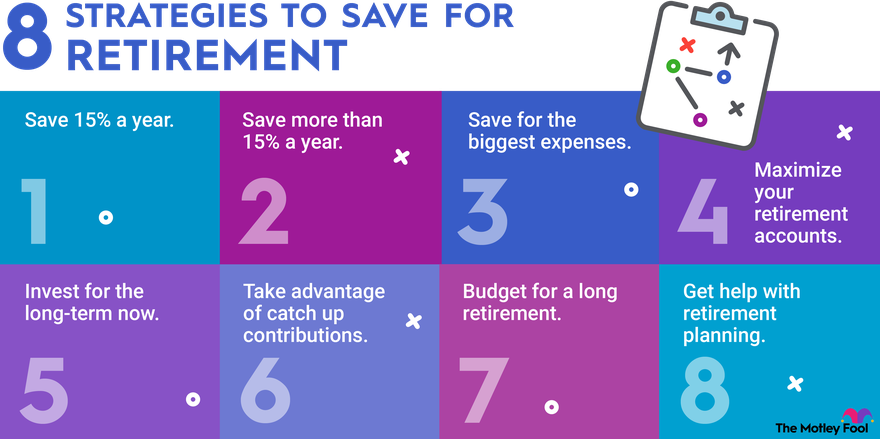

This image is property of m.foolcdn.com.

Investment Strategies

Buy and hold strategy

The buy and hold strategy is a common investment approach for retirement investors. With this strategy, investors purchase discounted bonds and hold them until maturity, regardless of any fluctuations in their market value. This strategy allows investors to benefit from the fixed income stream and the return of the bond’s face value at maturity. The buy and hold strategy is suitable for investors with a long-term investment horizon and a focus on generating steady income for retirement.

Bond ladder strategy

The bond ladder strategy involves purchasing bonds with staggered maturities to create a steady income stream and mitigate interest rate risk. Retirement investors can implement a bond ladder by buying bonds with varying maturity dates, such as one-year, three-year, five-year, and ten-year bonds. As each bond matures, the proceeds can be reinvested in new bonds with longer maturities. The bond ladder strategy provides a balanced approach to earning income and managing interest rate risk.

Bond mutual funds

Bond mutual funds offer a convenient way for retirement investors to gain exposure to discounted bonds. These funds pool money from multiple investors to invest in a diversified portfolio of bonds. By investing in bond mutual funds, investors can benefit from professional management and the ability to easily buy or sell shares. Retirement investors should carefully evaluate the fees, expenses, and performance history of mutual funds before investing to align with their investment objectives.

Tax Considerations

Tax implications of discounted bonds

Retirement investors should be aware of the potential tax implications of investing in discounted bonds. The interest income received from discounted bonds is generally subject to federal, state, and local income taxes. The tax rate will vary depending on the investor’s income tax bracket. Additionally, if bonds are sold before maturity, any capital gains or losses may be subject to capital gains taxes. It is important to consult a tax advisor to understand the specific tax obligations associated with investing in discounted bonds.

Qualified retirement accounts

Investing in discounted bonds through qualified retirement accounts, such as traditional IRAs or employer-sponsored 401(k) plans, can provide tax advantages. Contributions to these accounts are typically tax-deductible, and earnings on investments grow tax-deferred until withdrawal during retirement. By investing in discounted bonds within a qualified retirement account, investors can potentially defer taxes on the interest income until retirement, providing an opportunity for tax-efficient growth.

Tax-efficient investment planning

Retirement investors should consider tax-efficient investment planning when investing in discounted bonds. Strategies such as tax-loss harvesting, which involves selling investments at a loss to offset capital gains, can help minimize tax liabilities. Additionally, investors may strategically allocate certain types of investments, such as tax-exempt municipal bonds, within taxable accounts to reduce tax obligations. Working with a tax advisor or financial planner can help retirees develop a tax-efficient investment plan that aligns with their financial goals.

This image is property of m.foolcdn.com.

Professional Guidance

Consulting a financial advisor

Retirement investors can benefit from consulting a financial advisor when considering discounted bonds. A financial advisor can provide personalized guidance, taking into account an investor’s risk tolerance, financial goals, and time horizon. They can help evaluate investment options, develop a comprehensive retirement strategy, and provide ongoing portfolio management. A knowledgeable advisor can navigate the complexities of discounted bonds and assist in making informed investment decisions.

Working with a bond specialist

Given the intricacies of the bond market, working with a bond specialist can be advantageous for retirement investors. Bond specialists have in-depth knowledge of different types of bonds, credit ratings, and market trends. They can provide valuable insights, help identify suitable bonds for investment, and optimize bond portfolios for retirement income. A bond specialist can also assist in assessing the creditworthiness of the issuer and monitor for any changes that may impact the investment.

Considering retirement planning services

Retirement planning services can offer comprehensive solutions for retirement investors seeking professional guidance. These services often combine financial planning, investment management, and tailored retirement advice. By partnering with a retirement planning service, investors can have access to a team of experts who specialize in retirement strategies, including discounted bonds. They can help create a customized retirement plan and provide ongoing support to ensure financial goals are met.

Monitoring and Adjusting Investments

Regular portfolio review

Retirement investors should regularly review their portfolio to ensure it aligns with their investment objectives and risk tolerance. By conducting periodic portfolio reviews, investors can assess the performance of their discounted bond investments, check for any changes in credit ratings, and adjust allocations if needed. It is important to stay informed about market conditions, economic trends, and any factors that may impact the performance of discounted bonds.

Rebalancing retirement investments

Rebalancing retirement investments is a critical step in maintaining a diversified portfolio. Over time, the value of different investments within a portfolio may shift, causing the allocation to deviate from the target. Retirement investors should periodically rebalance their portfolio by buying or selling assets to restore the desired asset allocation. Rebalancing ensures that the risk exposure remains in line with the investor’s risk tolerance and investment goals.

Optimizing investment returns

Retirement investors should continuously strive to optimize their investment returns. This involves actively managing the portfolio, monitoring market conditions, and exploring opportunities to increase income or achieve higher yields. Optimizing returns may include considering alternative discounted bond options, exploring new investment vehicles, or adjusting the allocation to different sectors or regions. By regularly assessing and refining investments, retirement investors can maximize their chances of achieving long-term financial success.

In conclusion, discounted bonds can be a valuable addition to a retirement investment strategy. By understanding the different types of discounted bonds, considering key factors, and implementing effective investment strategies, retirement investors can benefit from the income, stability, and potential returns offered by discounted bonds. Seeking professional guidance, monitoring investments, and adapting strategies as needed helps ensure a successful retirement investment journey. Remember to consider your personal financial goals, risk tolerance, and consult with experts to make informed decisions that best align with your retirement needs.