Imagine a future where you can enjoy a relaxing retirement while also contributing to a cleaner and more sustainable world. With retirement investments for green energy, this scenario can become a reality. By putting your hard-earned money into renewable energy projects, you not only secure your financial future but also support the transition towards a greener planet. In this article, we will explore the exciting opportunities that green energy retirement investments offer and how they can align with your personal values and goals. So, grab a cup of tea and get ready to discover the potential of investing in a brighter future.

Types of Retirement Investments

Stocks

Stocks are a popular type of retirement investment that provide ownership in a company. Investing in green energy stocks allows you to support environmentally friendly companies while potentially earning significant returns. Companies involved in renewable energy, such as solar or wind power, offer opportunities for growth as the demand for clean energy continues to rise.

Bonds

Retirement investors can also consider investing in green bonds, which are specifically issued to fund environmentally-friendly projects. Green bonds can be an attractive option for those seeking more stable returns, as they typically offer fixed interest payments and have a lower risk compared to stocks. Investing in green bonds allows you to support green initiatives while earning a reliable income.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of green energy companies. By investing in green energy mutual funds, you can benefit from professional management and a diversified portfolio, reducing the risk associated with investing in individual stocks. This option is suitable for retirees looking for a hands-off approach to investing in green energy.

Exchange-Traded Funds (ETFs)

ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. Green energy ETFs invest in a basket of green energy companies, providing investors with exposure to the entire green energy sector. ETFs offer liquidity, lower expense ratios, and can be a suitable option for retirees who prefer the flexibility of buying and selling shares throughout the trading day.

Real Estate Investments

Investing in green real estate can be a lucrative retirement investment strategy. Green real estate investments involve properties that are energy-efficient, environmentally friendly, and sustainable. These investments not only offer potential financial returns but also contribute to a healthier and more sustainable planet. Green real estate investments can include residential, commercial, or industrial developments.

Benefits of Investing in Green Energy

Environmental Impact

Investing in green energy has a significant positive impact on the environment. By allocating your retirement funds towards renewable energy projects, you can contribute to reducing greenhouse gas emissions, mitigating climate change, and promoting a cleaner and more sustainable future for generations to come.

Financial Returns

Investing in green energy can provide attractive financial returns. As the demand for renewable energy continues to grow, the value of green energy investments may increase. Additionally, renewable energy sources often benefit from government incentives and subsidies, increasing the potential for long-term returns on investment.

Reduced Regulatory Risks

Green energy investments are less susceptible to regulatory risks compared to traditional energy sources. Governments around the world are increasingly implementing policies and regulations that support the growth of renewable energy. By investing in green energy, you can minimize the risks associated with fluctuating regulations and support industries that are positioned for long-term success.

Diversification

Including green energy investments in your retirement portfolio helps diversify your overall investment strategy. Diversification is a key principle in retirement investing, as it spreads risk across different asset classes. By adding green energy investments alongside traditional investments, you can reduce vulnerability to market fluctuations and potentially enhance your overall portfolio performance.

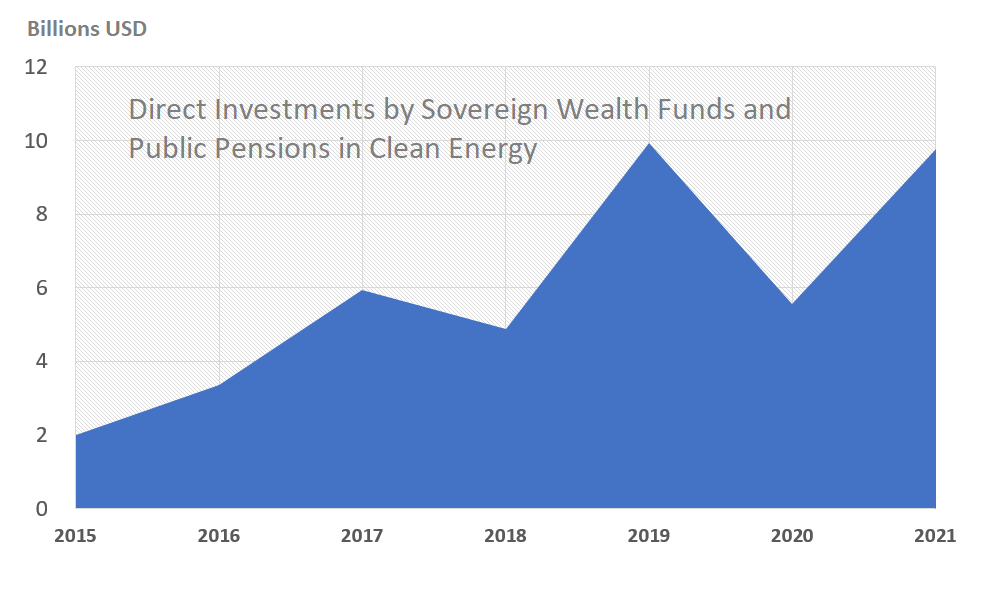

This image is property of energyminute.ca.

Green Energy Investment Options

Renewable Energy Companies

One option for investing in green energy is to directly invest in renewable energy companies. These companies develop and operate renewable energy projects, such as solar farms, wind turbines, or geothermal plants. By investing in these companies, you can support the expansion of clean energy sources and potentially benefit from their financial success.

Solar Energy

Investing in solar energy involves funding solar projects, such as the installation of solar panels on residential or commercial properties. Solar energy is a rapidly growing industry, supported by declining costs of solar technology and increased government incentives. Investing in solar energy allows you to contribute to a more sustainable future while potentially earning stable returns.

Wind Energy

Wind energy investments involve financing wind power projects, such as the construction and operation of wind turbines. Wind energy is a mature industry with established technological advancements and a proven track record. By investing in wind energy, you can support the generation of clean, renewable power and potentially benefit from steady returns.

Hydropower

Hydropower investments focus on funding projects that generate electricity from flowing or falling water. Hydropower is a reliable and well-established source of renewable energy, with significant potential for growth. By investing in hydropower, you can support the development of sustainable energy infrastructure and potentially earn stable returns.

Geothermal Energy

Geothermal energy investments involve financing the development and operation of geothermal power plants. Geothermal energy utilizes the heat from the Earth’s core to generate electricity or provide heating and cooling. Investing in geothermal energy allows you to support the utilization of clean energy technology and potentially earn attractive returns.

Tax Advantages for Green Energy Investments

Investment Tax Credits (ITC)

The Investment Tax Credit (ITC) is a federal tax incentive that allows individuals to deduct a percentage of the cost of qualifying green energy investments from their tax liability. This credit can significantly reduce the upfront costs of investing in green energy, making it more financially feasible for retirees.

Production Tax Credits (PTC)

Production Tax Credits (PTC) are another federal tax incentive available for certain renewable energy projects. The PTC provides a subsidy for each unit of electricity produced by qualifying renewable energy facilities over a specific period of time. By investing in projects eligible for PTCs, retirees can benefit from additional tax advantages.

Low-Income Housing Tax Credit (LIHTC)

The Low-Income Housing Tax Credit (LIHTC) is a tax incentive designed to encourage the development of affordable housing for low-income individuals and families. Green energy investments that incorporate energy-efficient features into affordable housing projects may qualify for LIHTC benefits. This tax credit can provide additional financial incentives for retirees interested in investing in green energy projects.

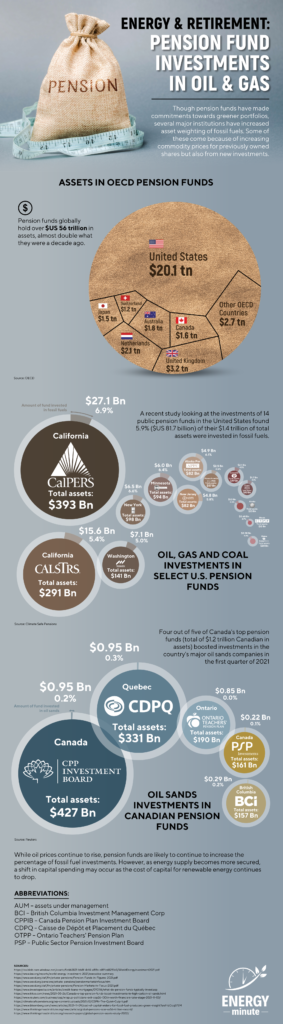

This image is property of assets.bwbx.io.

Risks and Challenges of Green Energy Investments

Policy and Regulatory Changes

Green energy investments are subject to policy and regulatory changes that can affect their financial performance. Government support, subsidies, and incentives can change over time, impacting the profitability of certain projects. It is important for retirees to stay informed about potential regulatory changes and adapt their investment strategies accordingly.

Technological Advancements

Advancements in technology can also pose risks for green energy investments. While technological progress in the renewable energy sector can lead to cost reductions and increased efficiency, it may also render certain projects or technologies obsolete. Retirees should consider the potential impact of technological advancements when evaluating and selecting green energy investment opportunities.

Volatility and Uncertainty

Like any investment, green energy investments can be subject to market volatility and uncertainty. External factors such as economic conditions, geopolitical events, and global trends can all impact the performance of green energy investments. Retirees should be prepared for potential fluctuations in the market and consider their risk tolerance when investing in green energy.

Project Financing Risks

Financing green energy projects can involve various risks, including delays in securing funding or changes in project costs. Green energy investments often require significant upfront capital, and any delays or complications in project financing can impact their viability. Retirees should carefully evaluate the financial stability and track record of project developers before investing in green energy projects.

Factors to Consider before Investing

Financial Goals and Risk Tolerance

Before making any investment, retirees should consider their financial goals and risk tolerance. Green energy investments can vary in terms of returns and risk levels. It’s essential to align your investment strategy with your financial objectives and determine how much risk you are comfortable taking.

Market Trends and Opportunities

Staying informed about market trends and opportunities is crucial when considering green energy investments. Researching the current state of the renewable energy industry, such as the adoption of green energy technologies and government policies, can help retirees identify promising investment opportunities.

Long-Term Sustainability

Investing in green energy is not only about financial returns, but also the long-term sustainability of the planet. Retirees should carefully evaluate the environmental impact and long-term viability of green energy investments before committing their retirement funds. Investing in projects and companies that align with sustainable practices can provide a sense of fulfillment and contribute to a healthier planet.

Expert Advice and Due Diligence

Retirees new to green energy investments may benefit from seeking expert advice and conducting thorough due diligence. Consulting with financial advisors or investment professionals who specialize in green energy can provide valuable insights and help retirees make informed decisions. It is crucial to thoroughly research potential investments and understand the risks associated with each option.

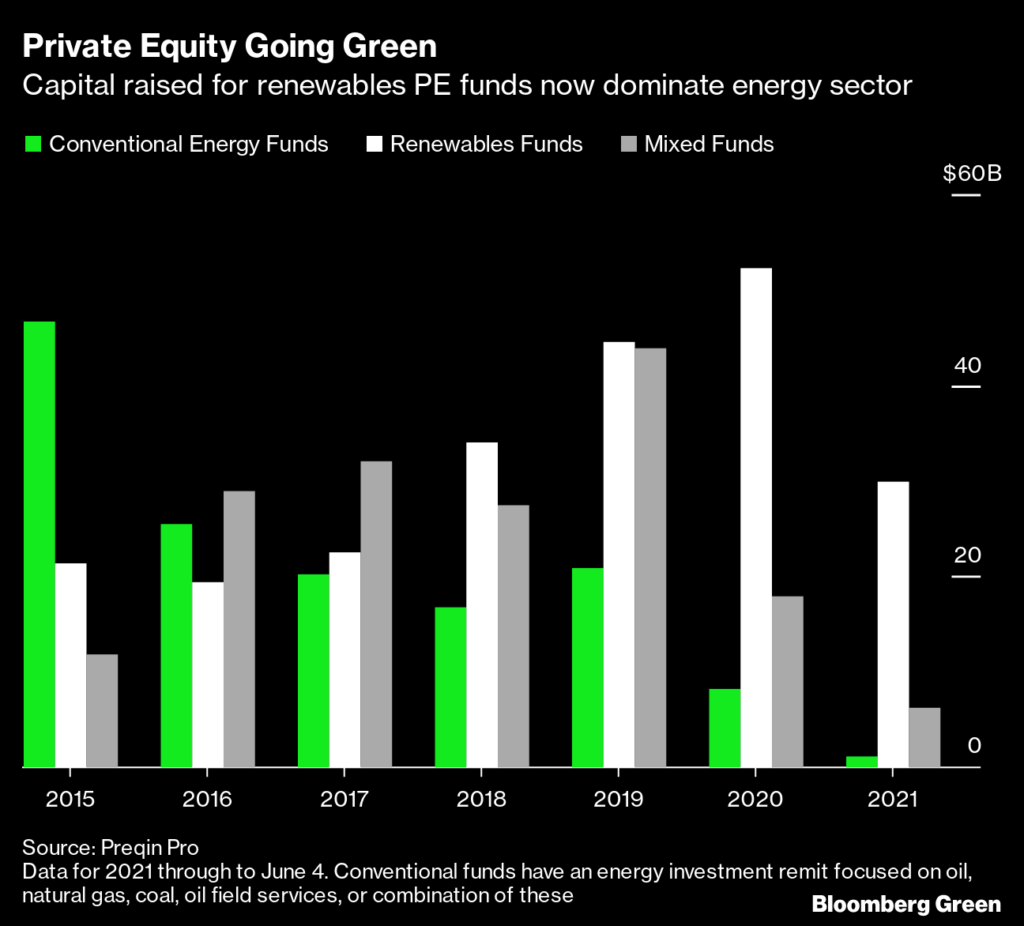

This image is property of si-interactive.s3.amazonaws.com.

Investing in Renewable Energy ETFs

Overview of Renewable Energy ETFs

Renewable Energy Exchange-Traded Funds (ETFs) provide investors with exposure to the entire green energy sector. These ETFs invest in a diversified basket of green energy companies, offering the potential for long-term growth. ETFs are traded on stock exchanges, providing liquidity and ease of transaction for retirees.

Top Performing Renewable Energy ETFs

Some of the top-performing renewable energy ETFs include the Invesco Solar ETF, iShares Global Clean Energy ETF, and First Trust Nasdaq Clean Edge Green Energy Index Fund. These ETFs track the performance of various green energy indices and have demonstrated strong returns over time. Retirees should carefully compare the performance, expense ratios, and investment strategies of different ETFs before making a decision.

Diversifying Your Investment Portfolio

Investing in renewable energy ETFs can be a strategic way to diversify your retirement investment portfolio. By allocating a portion of your funds to green energy ETFs, you can spread the risk across different companies and sectors within the green energy industry. Diversification helps retirees mitigate the impact of any underperforming investments and potentially enhance their overall portfolio returns.

Green Real Estate Investment Trusts (REITs)

Benefits of Investing in Green REITs

Green Real Estate Investment Trusts (REITs) offer retirees the opportunity to invest in environmentally-friendly real estate projects. These REITs focus on properties that are energy-efficient, sustainable, and have a positive environmental impact. Investing in green REITs allows retirees to support green building initiatives while potentially earning stable returns.

Choosing the Right Green REITs

When selecting green REITs, retirees should consider factors such as the track record of the REIT manager, the quality of the properties in the portfolio, and the overall financial performance of the REIT. It’s important to evaluate the REIT’s commitment to sustainability, adherence to environmental standards, and alignment with your own investment criteria.

Performance of Green REITs in the Market

Green REITs have shown promising performance in recent years, as sustainable building practices and energy efficiency gain traction. The demand for environmentally-friendly properties is expected to increase, potentially benefiting green REIT investors. Retirees interested in investing in green real estate should closely monitor the market trends and performance of green REITs before making a decision.

This image is property of www.advantaira.com.

Investing in Green Bonds

What Are Green Bonds?

Green bonds are fixed-income investments that are specifically issued to fund environmentally-friendly projects. These projects can include renewable energy, energy efficiency, sustainable transportation, and more. Investing in green bonds allows retirees to support green initiatives while earning a predictable stream of income.

Types of Green Bond Projects

Projects financed by green bonds can vary widely, including solar and wind energy installations, green building construction, and sustainable transportation infrastructure. Green bond investors can choose from a range of projects that align with their personal values and investment objectives. Retirees should carefully evaluate the specific projects tied to each green bond before investing.

Advantages and Risks of Green Bonds

Green bonds offer several advantages, including stable income through fixed interest payments, potential tax advantages, and the ability to support environmental projects. However, they also come with certain risks. Investors should assess the creditworthiness of the issuer, the liquidity of the investment, and the overall market conditions before investing in green bonds.

Investment Strategies for Green Energy

Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy that involves regularly investing a fixed amount of money into green energy investments, regardless of market conditions. This strategy allows retirees to benefit from market fluctuations by purchasing more shares when prices are low and fewer shares when prices are high, potentially resulting in a lower average cost over time.

Asset Allocation

Asset allocation is the practice of diversifying investment funds across different asset classes, such as stocks, bonds, and real estate. Allocating a portion of your retirement portfolio to green energy investments can be an effective way to diversify your asset allocation strategy and potentially capture the growth opportunities offered by the green energy sector.

Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans (DRIPs) allow retirees to use dividends earned from green energy investments to automatically purchase additional shares instead of receiving cash payments. This strategy can enhance the compounding effect of your investments over time, potentially accelerating the growth of your retirement portfolio.

Regular Portfolio Evaluation

Regularly evaluating your green energy investments is crucial to ensure they align with your financial goals and risk tolerance. Retirees should periodically review the performance of their green energy investments, assess any changes in market dynamics, and make adjustments to their portfolio as needed. Consulting with investment professionals can provide valuable insights during this evaluation process.

In conclusion, investing in green energy can provide retirees with financial returns, environmental impact, and diversification benefits. Whether through stocks, bonds, mutual funds, ETFs, or real estate investments, retirees have a wide range of options to invest in green energy. Considering factors such as financial goals, risk tolerance, and market trends, along with incorporating investment strategies, can help retirees make informed decisions and contribute to a greener and more sustainable future.