Are you looking for smart ways to generate income during your retirement? Look no further! In this article, we will explore various retirement investment options that can help you secure a steady stream of income. With a range of choices available, from dividend stocks to real estate investment trusts (REITs), you’ll discover strategies to make your money work for you so you can enjoy a financially comfortable retirement. So let’s dive into the world of retirement investments for income and start planning for a worry-free future!

Retirement Investments For Income

This image is property of static.wixstatic.com.

Understanding Retirement Investments

As you approach retirement, it’s important to start thinking about how you will generate income to sustain your lifestyle. Retirement investments provide a means to generate a steady income stream during your golden years. Before diving into specific investment options, it’s essential to understand the different types of retirement investments and how they work.

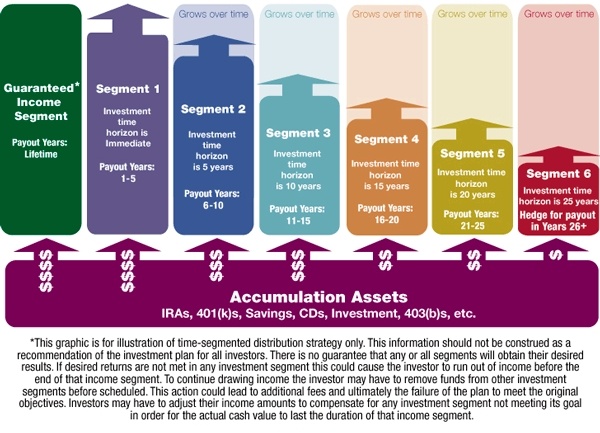

Retirement investments typically fall into two categories: income investments and growth investments. Income investments focus on generating regular income, while growth investments aim to increase the value of your portfolio over time. For those seeking steady income, it’s crucial to focus on income investments to ensure a reliable cash flow during retirement.

Factors to Consider When Investing for Retirement Income

When investing for retirement income, several factors need to be considered to create a strategy that aligns with your financial goals and risk tolerance. Firstly, it’s important to analyze your anticipated retirement expenses. By understanding your financial needs, you can determine how much income you’ll require during retirement.

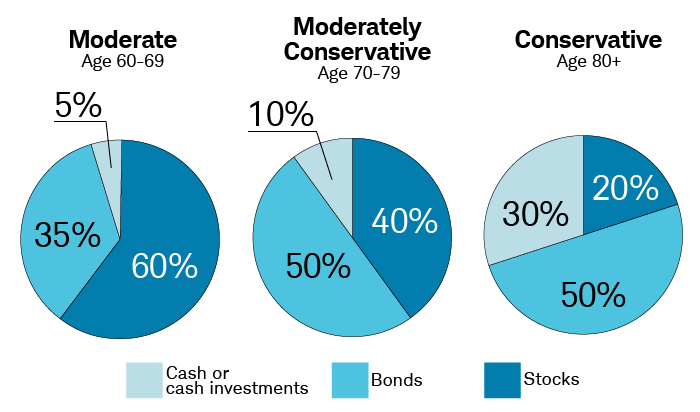

Secondly, evaluate your risk tolerance. Some individuals are comfortable taking on more risk in the pursuit of higher returns, while others prefer a more conservative approach. Consider how much volatility you are willing to tolerate and adjust your investment strategy accordingly.

Lastly, consider your time horizon. How long do you anticipate needing retirement income? This will play a significant role in determining the appropriate mix of investments in your portfolio. It’s important to strike a balance between generating income in the short term and ensuring your investments provide for your long-term needs.

This image is property of m.foolcdn.com.

Balancing Risk and Return

When it comes to retirement investments, it’s all about balancing risk and return. Higher-risk investments tend to offer greater potential returns, but they also come with an increased chance of significant losses. On the other hand, more conservative investments may provide a lower potential return but come with lower risk.

It’s crucial to find the right balance between risk and return that suits your financial situation and goals. Diversification is a key strategy to mitigate risk. By spreading your investments across different asset classes and sectors, you can reduce the impact of any single investment’s poor performance on your overall portfolio.

Investment Options for Retirement Income

Now that we’ve covered the basics, let’s dive into some specific investment options for retirement income. Keep in mind that it’s essential to consult with a financial advisor to determine the best options for your unique circumstances.

1. Social Security

Social Security benefits should be the foundation of your retirement income plan. These benefits are typically based on your earnings history and can provide a reliable source of income throughout your retirement years. It’s important to understand the rules and regulations surrounding Social Security to maximize your benefits.

2. Pensions

If you’re fortunate enough to have a pension, it can be a significant source of retirement income. Pensions typically provide regular payments for life, based on your years of service and average salary. However, not all retirees have access to a pension, as they’ve become less common in recent years.

3. Annuities

Annuities are another popular option for retirement income. With an annuity, you contribute a lump sum to an insurance company in exchange for regular payments for a specified period or for the rest of your life. Annuities provide guaranteed income and can help ensure you won’t outlive your savings.

4. Dividend-Paying Stocks

Dividend-paying stocks offer the potential for both income generation and capital appreciation. These stocks distribute a portion of the company’s profits to shareholders in the form of dividends. For retirees seeking income, dividend-paying stocks can be a valuable addition to their investment portfolio.

5. Bonds

Bonds are debt instruments issued by governments, municipalities, and corporations to raise capital. When you invest in bonds, you are essentially lending money to the issuer in exchange for regular interest payments. Bonds are often considered less risky than stocks and can provide a steady income stream during retirement.

6. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts, or REITs, are companies that own and manage income-generating properties such as apartments, office buildings, and shopping centers. By investing in REITs, you can benefit from the rental income generated by these properties. REITs offer the potential for income and potential capital appreciation.

7. Certificate of Deposits (CDs)

Certificate of Deposits, or CDs, are time deposits offered by banks and credit unions. They provide a fixed interest rate and have a predetermined maturity date. CDs are considered a low-risk investment option, making them an attractive choice for retirees seeking a stable income with minimal risk.

8. Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, and other securities. By investing in a mutual fund, you gain access to a professionally managed portfolio without the need for extensive investment knowledge. Some mutual funds focus on generating income, making them suitable for retirees.

9. Exchange-Traded Funds (ETFs)

Exchange-Traded Funds, or ETFs, are similar to mutual funds but trade on stock exchanges like individual stocks. ETFs offer diversification and flexibility, and some are designed to generate income. They can be a cost-effective way to gain exposure to a broad range of assets and generate income in retirement.

10. Rental Properties

Investing in rental properties can provide a consistent stream of rental income during retirement. However, it’s important to consider the responsibilities and potential challenges that come with being a landlord, such as property maintenance and finding reliable tenants.

This image is property of static.fmgsuite.com.

Diversifying Your Retirement Income Portfolio

To mitigate risk and protect against market volatility, diversify your retirement income portfolio. Diversification involves spreading your investments across different asset classes, industries, and geographic locations. By diversifying, you reduce the impact of any single investment on your overall portfolio, increasing the likelihood of consistent income generation.

Seeking Professional Financial Advice

When it comes to planning for retirement income, seeking professional financial advice is highly recommended. A financial advisor can help analyze your financial situation, understand your goals, and create a tailored investment strategy. They can also provide guidance on the tax implications of your investment decisions and help ensure you’re on track to meet your retirement goals.

This image is property of www.schwab.com.

Conclusion

Retirement investments for income are a crucial consideration as you prepare for your golden years. By understanding the different investment options available and considering factors such as risk tolerance and time horizon, you can create a diversified portfolio that generates a steady income stream. Remember to consult with a financial advisor to ensure your investment strategy aligns with your unique circumstances and goals. With proper planning and the right investments, you can enjoy a financially secure retirement.