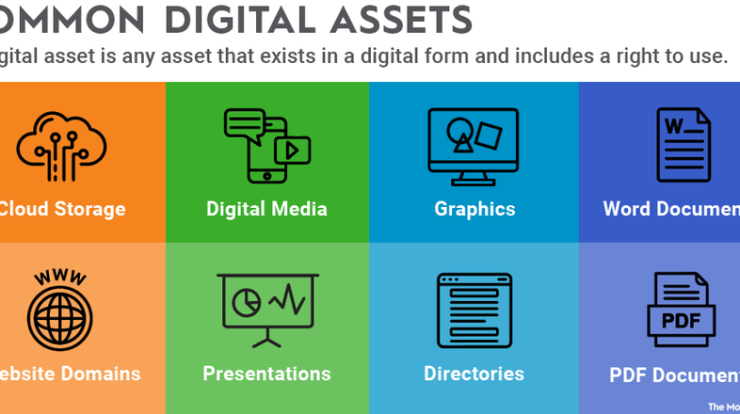

So, you’re looking to invest in digital assets and you want to explore the option of a Gold IRA. Well, you’ve come to the right place! In this article, we’ll be taking a closer look at the top Gold IRA companies that are perfect for your digital asset investments. From industry-leading expertise to exceptional customer service, these companies have proven themselves in the market and are ready to help you navigate the world of digital assets within your IRA. So sit back, relax, and let’s dive into the world of investment possibilities!

Top Gold IRA Companies for Digital Asset Investments

When it comes to investing in digital assets, such as Bitcoin or other cryptocurrencies, having a reliable and reputable custodian is crucial. That’s where Gold IRA companies come in, providing a secure and regulated way to invest in these emerging assets. In this article, we will take a comprehensive look at the top Gold IRA companies for digital asset investments and explore their backgrounds, investment options, security measures, fees and pricing, as well as the pros and cons of each company. So let’s dive in!

1. Regal Assets

Background and Overview

Regal Assets is a well-established company in the precious metals industry, known for its expertise in gold IRAs. With a focus on innovation, Regal Assets has expanded its offerings to include digital asset investments as well. They have been featured in various renowned publications, such as Forbes and Inc. 500, and boast an A+ rating from the Better Business Bureau.

Types of Investments

Regal Assets allows investors to diversify their portfolios with a range of digital assets, including Bitcoin, Ethereum, Litecoin, and more. They offer both physical allocation and non-physical allocation options, giving investors flexibility in their investment strategies.

Security Measures

Regal Assets prioritizes the security of their clients’ investments. They use offline cold storage wallets and multi-signature technology to safeguard digital assets. Additionally, they have an insurance policy that covers theft or loss up to $20 million.

Fees and Pricing

Regal Assets charges a flat fee of $250 per year for account management. This fee covers all administrative and storage costs associated with digital asset investments.

Pros and Cons

Pros:

- Well-established company with a strong reputation

- Wide range of digital asset investment options

- High level of security measures and insurance coverage

- Flat fee structure

Cons:

- Higher minimum investment requirement compared to some other companies

2. Bitcoin IRA

Background and Overview

Bitcoin IRA is a specialized company that focuses solely on facilitating investments in Bitcoin for individual retirement accounts. They have gained recognition for being the world’s first company to offer Bitcoin-based IRAs and have been featured in reputable publications like CNBC and Bloomberg.

Types of Investments

Bitcoin IRA allows investors to invest solely in Bitcoin, which may be suitable for those who have a strong belief in the long-term potential of this digital asset.

Security Measures

Bitcoin IRA prioritizes security by utilizing cryptocurrency exchange partners that have implemented robust security measures. These partners employ advanced security features, including multi-signature wallets and cold storage.

Fees and Pricing

Bitcoin IRA charges a one-time setup fee, which varies depending on the investment amount. They also have an annual maintenance fee based on a percentage of the total account value.

Pros and Cons

Pros:

- Specialized in Bitcoin investments for IRAs

- Established partnerships with secure cryptocurrency exchanges

- Access to Bitcoin’s potential upside

Cons:

- Limited to Bitcoin investments only

- Annual maintenance fees based on percentage of account value

3. Noble Gold

Background and Overview

Noble Gold is a company that specializes in precious metals IRAs and has recently expanded its services to include digital assets. They aim to provide a comprehensive solution for investors who wish to diversify their portfolios with both traditional and digital assets. Noble Gold has garnered positive reviews from clients and maintains a high rating on various consumer review platforms.

Types of Investments

Noble Gold offers a wide range of investment options, including Bitcoin, Ethereum, Ripple, and other popular cryptocurrencies. They also provide the option to include physical precious metals within the same IRA account.

Security Measures

To ensure the security of clients’ digital assets, Noble Gold employs measures such as cold storage wallets, encryption technology, and multi-factor authentication. They also have an insurance policy that covers theft, hacking, and fraud.

Fees and Pricing

Noble Gold charges a flat monthly fee for account administration, covering all costs associated with maintaining digital asset investments within an IRA.

Pros and Cons

Pros:

- Established reputation in the precious metals industry

- Diversification options with a combination of digital assets and physical precious metals

- Robust security measures and insurance coverage

- Flat monthly fee structure

Cons:

- Limited cryptocurrency options compared to some other companies

4. Advantage Gold

Background and Overview

Advantage Gold is a trusted name in the gold IRA industry, offering a seamless process for investors to open and manage their digital asset IRAs. They pride themselves on providing personalized service and transparent pricing, helping individuals make informed investment decisions.

Types of Investments

Advantage Gold offers a variety of digital asset options, including Bitcoin, Ethereum, Litecoin, and others. They also offer the option to include physical precious metals within the same IRA account.

Security Measures

To safeguard clients’ digital assets, Advantage Gold uses cold storage wallets, multi-signature technology, and encryption protocols. They conduct regular audits to ensure compliance with security standards.

Fees and Pricing

Advantage Gold charges a flat fee for account administration, covering all costs associated with digital asset investments. They also have a transparent pricing model, with no hidden fees or commissions.

Pros and Cons

Pros:

- Transparent pricing and personalized service

- Option to include physical precious metals within the same IRA account

- Robust security measures

- Flat fee structure

Cons:

- Limited cryptocurrency options compared to some other companies

5. Rosland Capital

Background and Overview

Rosland Capital is a respected name in the precious metals industry, offering a range of investment options for individuals looking to diversify their portfolios. They have recently expanded their services to include digital asset IRAs, providing a comprehensive solution for investors.

Types of Investments

Rosland Capital offers a selection of digital assets, including Bitcoin, Ethereum, and Ripple. They also provide the option to include physical precious metals within the same IRA account.

Security Measures

To ensure the security of clients’ digital assets, Rosland Capital utilizes offline cold storage wallets, encryption protocols, and multi-factor authentication. They also have an insurance policy in place to protect against theft or loss.

Fees and Pricing

Rosland Capital’s fees are based on a percentage of the total account value. They offer transparent pricing and strive to provide competitive rates within the industry.

Pros and Cons

Pros:

- Established reputation in the precious metals industry

- Diversification options with a combination of digital assets and physical precious metals

- Robust security measures and insurance coverage

- Transparent pricing

Cons:

- Percentage-based fees may be higher for larger account values

6. Birch Gold Group

Background and Overview

Birch Gold Group is a well-known company specializing in precious metals IRAs, and they have also expanded their services to include digital asset investments. With a focus on education and personalized service, Birch Gold Group aims to assist clients in making informed investment decisions.

Types of Investments

Birch Gold Group offers a selection of digital assets, including Bitcoin, Ethereum, Litecoin, and others. They also provide the option to include physical precious metals within the same IRA account.

Security Measures

To ensure the security of clients’ digital assets, Birch Gold Group employs advanced security measures, including cold storage wallets and encryption technology. They also collaborate with trusted custodians who implement stringent security protocols.

Fees and Pricing

Birch Gold Group’s fees are based on a percentage of the total account value. They strive to provide competitive rates while delivering personalized service and comprehensive support.

Pros and Cons

Pros:

- Established reputation in the precious metals industry

- Diversification options with a combination of digital assets and physical precious metals

- Advanced security measures

- Personalized service and comprehensive support

Cons:

- Percentage-based fees may be higher for larger account values

7. Augusta Precious Metals

Background and Overview

Augusta Precious Metals is a customer-focused company specializing in precious metals IRAs. They have recently expanded their services to include digital asset investments, aiming to provide clients with a comprehensive solution for portfolio diversification.

Types of Investments

Augusta Precious Metals offers a variety of digital asset options, including Bitcoin, Ethereum, Ripple, and other popular cryptocurrencies. They also provide the option to include physical precious metals within the same IRA account.

Security Measures

To ensure the security of clients’ digital assets, Augusta Precious Metals uses a combination of cold storage wallets, multi-signature technology, and rigorous security protocols. They also have insurance coverage to protect against potential risks.

Fees and Pricing

Augusta Precious Metals charges a flat fee for account administration, covering all costs associated with maintaining digital asset investments within an IRA.

Pros and Cons

Pros:

- Focus on customer satisfaction and personalized service

- Diversification options with a combination of digital assets and physical precious metals

- Robust security measures

- Flat fee structure

Cons:

- Limited cryptocurrency options compared to some other companies

8. American Hartford Gold

Background and Overview

American Hartford Gold is a leading provider of precious metals IRAs, known for their commitment to transparent pricing, customer education, and excellent service. They have expanded their offerings to include digital asset investments, providing investors with the opportunity for portfolio diversification.

Types of Investments

American Hartford Gold offers a selection of digital assets, including Bitcoin, Ethereum, Litecoin, and others. They also provide the option to include physical precious metals within the same IRA account.

Security Measures

To ensure the security of clients’ digital assets, American Hartford Gold utilizes cold storage wallets, encryption technology, and multi-factor authentication. They work with trusted third-party custodians who adhere to strict security standards as well.

Fees and Pricing

American Hartford Gold’s fees are based on a percentage of the total account value. They provide transparent pricing with no hidden fees or commissions.

Pros and Cons

Pros:

- Transparent pricing and commitment to customer education

- Diversification options with a combination of digital assets and physical precious metals

- Robust security measures

- Established partnerships with trusted custodians

Cons:

- Percentage-based fees may be higher for larger account values

9. Goldco

Background and Overview

Goldco is a reputable company specializing in precious metals IRAs. They have expanded their services to include digital asset investments, offering investors a comprehensive solution for diversifying their portfolios. Goldco is known for its focus on customer service and transparent pricing.

Types of Investments

Goldco offers a range of digital asset options, including Bitcoin, Ethereum, Ripple, and others. They also provide the option to include physical precious metals within the same IRA account.

Security Measures

To ensure the security of clients’ digital assets, Goldco employs stringent security measures, including cold storage wallets and multi-factor authentication. They also collaborate with trusted custodians who implement robust security protocols.

Fees and Pricing

Goldco’s fees are based on a percentage of the total account value. They strive to provide competitive rates while delivering personalized service and comprehensive support.

Pros and Cons

Pros:

- Established reputation in the precious metals industry

- Diversification options with a combination of digital assets and physical precious metals

- Stringent security measures

- Personalized service and comprehensive support

Cons:

- Percentage-based fees may be higher for larger account values

10. Lexi Capital

Background and Overview

Lexi Capital is a company that specializes in precious metals IRAs and has also ventured into the world of digital asset investments. They aim to provide clients with a diversified portfolio solution, combining the stability of precious metals with the growth potential of digital assets.

Types of Investments

Lexi Capital offers a selection of digital assets, including Bitcoin, Ethereum, Litecoin, and others. They also provide the option to include physical precious metals within the same IRA account.

Security Measures

To safeguard clients’ digital assets, Lexi Capital utilizes secure cold storage wallets and encryption technology. They work with trusted custodians who implement robust security measures as well.

Fees and Pricing

Lexi Capital’s fees are based on a percentage of the total account value. They aim to provide competitive rates while delivering personalized service and comprehensive support.

Pros and Cons

Pros:

- Focus on portfolio diversification with combined precious metals and digital assets

- Robust security measures

- Personalized service and comprehensive support

Cons:

- Percentage-based fees may be higher for larger account values

In conclusion, when considering investing in digital assets within a Gold IRA, it is crucial to choose a reputable and reliable custodian. The top Gold IRA companies for digital asset investments, such as Regal Assets, Bitcoin IRA, Noble Gold, Advantage Gold, Rosland Capital, Birch Gold Group, Augusta Precious Metals, American Hartford Gold, Goldco, and Lexi Capital, offer a range of options to suit different investor needs. It’s essential to carefully evaluate the background, types of investments, security measures, fees and pricing, as well as the pros and cons of each company before making an informed decision. Remember to consult with a financial advisor or IRA specialist to determine which Gold IRA company is the best fit for your investment goals and risk tolerance.